To understand why it is proving so hard to break up with coal, we worked with an international team of around 35 researchers to investigate the political economy drivers of its continued use.

We conducted 15 country case studies on what drives coal phaseouts – and what holds them back.

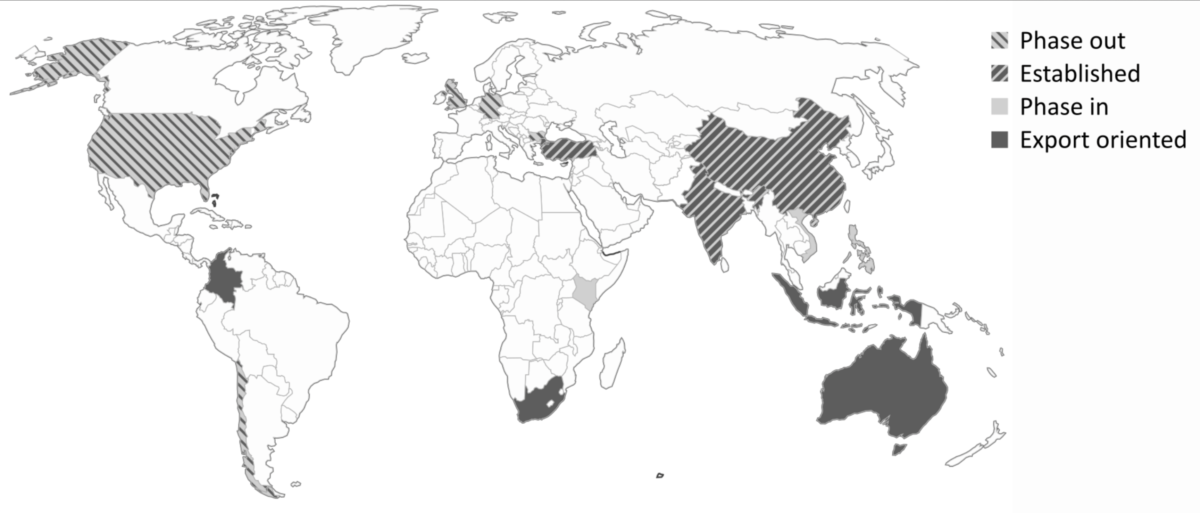

Despite highly country-specific contexts, we found that countries can be grouped into four broad clusters –

1. Coal phaseouts:

UK, US, Germany, Bulgaria, Chile.

Countries that have adopted targets to phase out coal are mostly high-income countries with high technological, administrative and financial capacities.

In these countries, we found the largest challenge to meeting coal phaseout targets will likely consist in adopting policies to ensure a just energy transition.

2. Coal phase-ins:

Philippines, Vietnam, Kenya.

These types of nation are often low-income countries, for which we found affordability and reliability to be key concerns.

Renewable projects, which require substantially up-front investments compared to coal-fired power plants, often struggle with high capital costs. These costs frequently arise from policy risks; for instance, in Vietnam and the Philippines, we found that coal-fired power plants benefit from more favourable regulatory treatment compared to renewable energy.

Measures to reduce policy risks for investors, by ensuring the long-term credibility of announced policies, as well as using “derisking instruments” to lower credit risks, could level the playing field and make renewable energy more attractive.

In addition, technical and administrative support to prepare electricity grids to deal with the variable nature of renewable power would help to accelerate the deployment of low-carbon energy sources.

3. Established coal users:

China, India, Turkey.

This group comprises middle-income countries, whose economic growth has to a large extent been fuelled by cheap coal power.

In these countries, coal is an important source of employment, regional development and public revenue, and is connected to strong vested interests.

In these countries, energy markets are dominated by state-owned enterprises, which we found to be prone to political meddling.

Liberalisation of their energy markets could be expected to speed up the transition away from coal. Measures to compensate political losers and ensure livelihoods of workers will be needed, in order to make coal phaseouts politically viable.

4. Coal exporters:

Colombia, Australia, South Africa, Indonesia.

In these countries coal constitutes an important source of employment, regional development and public revenue.

As a result, there are strong vested interests to maintain the extraction and export of coal. For instance, our case studies show that coal royalties account for a significant fraction of regional governments’ public budgets in Indonesia, as well as playing an important role in facilitating the peace process in Colombia. This makes it politically challenging to phase out coal.

One way for these countries to embrace an energy transition could be the provision of alternative revenue streams that satisfy the financial requirements of key stakeholders. For instance, in Australia, we found that the prospect of becoming an exporter of green hydrogen could counterbalance the political influence of the coal lobby.